$1 million term life insurance

Cardinal makes it easy to apply for an online life insurance policy that fits your needs. See if a million-dollar life insurance policy will be enough to help protect your family if the unexpected were to happen.

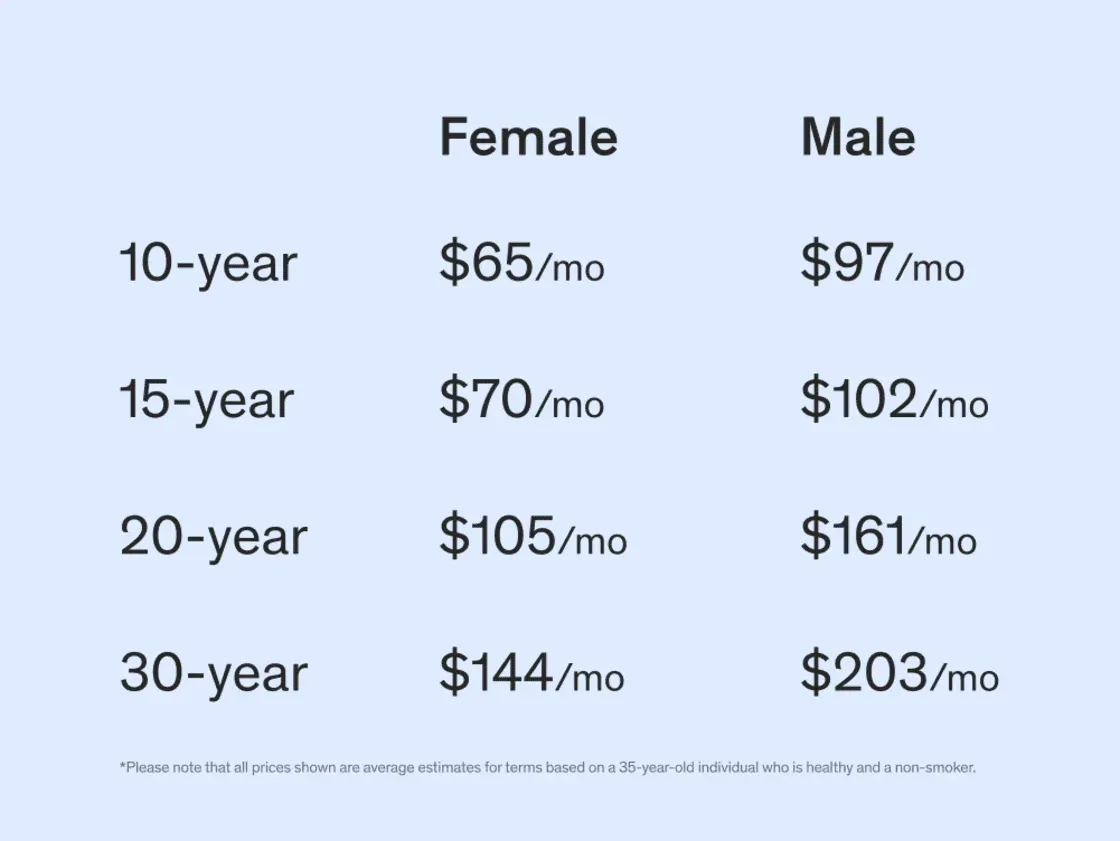

How much is a million-dollar life insurance policy?

Discover how Cardinal can help you get a policy of up to a million dollars at an affordable rate. This chart shows average 10- to 30-year term life policy premiums for healthy, non-smoking 35-year-old males and females.

Life insurance helps protect your loved ones

Your life insurance coverage can help secure your family’s financial future by covering living expenses, outstanding debt, mortgage payments, education, and more.

While no one answer covers every situation, there are guidelines to help you determine how much coverage you need.

A $1 million life insurance policy can offer protection for your loved ones if you pass away unexpectedly. But is it right for you?

It's recommended you carry at least ten times your annual salary. The DIME formula (debt + income + mortgage + education) is another helpful way to determine your coverage calculations. Adding these factors together can give you a better idea of your coverage needs.

- Debt - Total of all current debt (such as student loans or credit card balances)

- Income - Multiply your salary by the estimated number of years your family would need support ($100k salary x 10 years = $1 million)

- Mortgage - Mortgage balances or housing expenses

- Education - An estimate of the costs to fund your children's tuition

How can I qualify for a million-dollar life insurance policy?

- Age: Life insurance coverage costs more the older you get. The younger you are, the higher amount of coverage you'll qualify for.

- Health: The better your health status, the better your chance of being approved for a higher policy.

- Income: Many applicants can qualify for coverage up to 30 times their annual salary. Depending on how much you make and your financial situation, you may want to consider increasing your coverage.

How to get a million dollar policy with Cardinal?

Cardinal makes it quick and easy to apply for life insurance tailored to your budget and coverage needs.

Fast, free, online application process

Complete our online application in minutes. It's straightforward and requires no paperwork or phone calls (but if you'd like to talk to someone, we're available to help).

Affordable, personalized coverage

Cardinal offers a wide variety of coverage options to fit your budget and provide the coverage you need.

Honest advice, non-pushy agents

You don’t need to talk to an agent – unless you want to. Our agents are experts in finding you the coverage that best suits your family’s needs.

Easy, hassle-free cancellation

If you change your mind within the first 30 days of activating your coverage, we'll refund your payment in full. And with Cardinal, you can cancel your policy anytime with no extra fees.

Receive a free, personalized quote instantly

See estimated prices for up to $1 million in life insurance coverage.